In Focus: Advanced Production Technologies

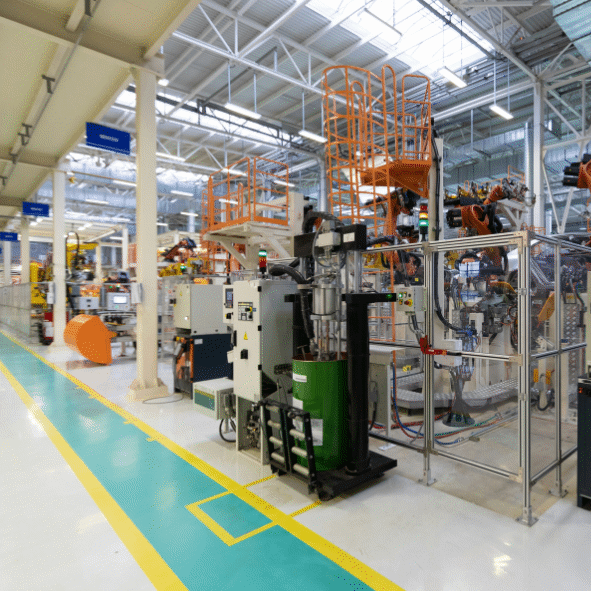

The region aims to become a center of excellence in advanced manufacturing technologies, harnessing the potential of Industry 4.0 and local innovation. In the long term, the vision is to establish a modern, digitalized, and sustainable industry integrated into European value chains. This involves smart factories, automated and robotic processes, as well as the adoption of new technologies (3D printing, Internet of Things, artificial intelligence) in production flows. As a result, the region will become more competitive globally, creating high-value-added products and generating skilled jobs in a green and digital economy.

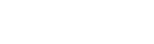

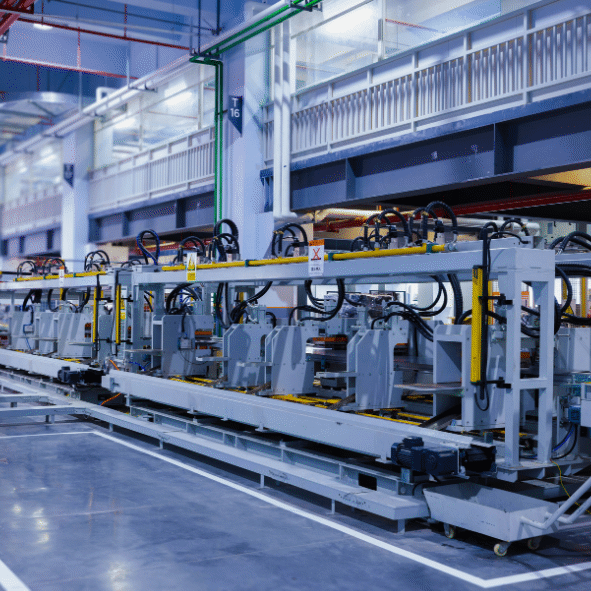

Industrial Robotics and Automation – Robotic and mechatronic solutions for factories (automated assembly lines, collaborative robots) boost productivity and are supported by 4.0 technologies identified as priorities.

Additive Manufacturing (3D Printing) – Rapid prototyping centers and 3D printers for metals and polymers enable cost-effective prototyping and small batch production in engineering, medicine, or aviation.

Machine Tools and Precision Mechanics – Investments in CNC metal processing (lathes, automated mills) modernize the region's metallurgy and automotive sectors.

Renewable Energy Equipment – Local production of wind turbines, solar panels, and industrial photovoltaic systems is driven by the energy transition; RIS3 NV foresees innovative machines for generating energy from renewable sources.

Energy Efficiency Equipment – Solutions such as smart grids, advanced electric motors, and automation equipment reduce industrial consumption (RIS3 mentions energy efficiency equipment).

Waste Transformation Automation – Production lines and facilities that convert waste into resources (e.g., advanced recycling, industrial composting) are part of the circular economy, supported by EU and local policies.

Electric Vehicles and Mobility Equipment – Investments in the production of electric bikes, e-mobility buses, or components for autonomous vehicles (e.g., assisted driving systems) support the European emission reduction strategy (RIS3 mentions autonomous mobility and e-mobility).

Advanced Agricultural Machinery – Automated tractors and farming equipment, connected via IoT for precision farming, bridging high-tech and agriculture.

Electronic and Microelectronics Equipment – Development of factories for electronic components (sensors, integrated circuits), leveraging regional research and European supply chains (semiconductors).

Advanced Control and Inspection Technologies – Artificial vision systems and 3D scanning for quality assurance in industrial production, supported by the demand for "smart factories."

Advanced Manufacturing for the Textile Industry – High-tech equipment for the textile industry (automated sewing machines, digital screen printing) capitalizes on a traditional sector in the region.

Industrial Software Technologies (Industry 4.0) – Investments in software platforms for planning and predictive maintenance, merging traditional productivity with digital advancement.

Innovation and entrepreneurship

In the field of advanced manufacturing, innovation plays a crucial role, but only a small portion of companies actively innovate. There is a noticeable emergence of tech startups focused on the manufacturing industry, from IoT solutions for factories to industrial robots and 3D printing. The region benefits from innovation networks such as clusters and digital hubs, which provide companies with advanced technology testing services and digital transformation consulting. All these elements create a developing entrepreneurial ecosystem, where traditional manufacturing companies are encouraged to adopt an innovation culture and collaborate with startups and research institutions.

Companies

The advanced manufacturing sector in the North-West includes both large companies and a wide range of subcontracting SMEs. Large multinational companies have played a catalytic role; for example, investments such as Bosch (Jucu, Cluj) in automotive components and research centers, Emerson (Cluj) in electrical equipment, Continental and Michelin (Sălaj), or Leoni (Bistrița) in automotive. These, along with other foreign investors, have brought know-how and advanced standards, generating local supplier clusters. The typology of companies varies across industrial subsectors: automotive and components (wiring, electronic components, metal parts) – a prominent sector in Bihor, Satu Mare, Bistrița; machinery and equipment manufacturing (machinery, subassemblies) – present in Cluj and Oradea; IT integrated with production – for example, smart equipment, sensors; the wood and furniture industry – traditional but undergoing technologization (Cluj, Maramureș); the food industry – also adopting automation (e.g., modern packaging lines).

Workforce

The workforce in the advanced manufacturing sector is large and varied in terms of skill levels. Urban centers like Cluj-Napoca and Oradea attract highly skilled labor due to the presence of technical universities, while industrial areas in Bihor, Satu Mare, or Maramureș rely on workers from rural areas, often with secondary education or vocational training. A strength of the region is the presence of a young, educated workforce in STEM fields, but challenges remain. Many companies report a shortage of specialized technical staff – for example, industrial robot programmers, mechatronics specialists, or process engineers – due to talent emigration and competition from the IT sector. At the same time, the employed population is aging: a significant portion of experienced workers (especially in traditional industries) is approaching retirement, putting pressure on the transfer of skills to the new generation. The region addresses these challenges by expanding dual education programs (collaborations between vocational schools and companies) and retraining existing employees to align the workforce with the requirements of new production technologies.

Average Wage

Wage levels in the regional industry reflect both employee specialization and sector competitiveness. Generally, the average net salary in industry in the North-West is slightly below the national average but is steadily increasing. Notable intra-regional differences exist: employees in high-tech factories (electronics, automotive) in Cluj or Oradea earn significantly more than those in traditional industries (e.g., textiles, furniture) in peripheral areas. However, the overall trend is towards convergence towards higher wage levels as companies modernize and require more advanced skills from their staff. The wage growth in manufacturing (around 7-10% annually in recent years) reflects both the need to retain the workforce (amid external migration) and increased productivity in companies that have invested in automation. A positive side effect of these wage increases is the growing interest among young people in careers in modern manufacturing, gradually narrowing the gap with sectors such as IT.

Education

The region has strong university centers, led by the Technical University of Cluj-Napoca, which trains hundreds of engineers annually in key fields: industrial engineering, robotics, computer science and automation, applied electronics. UTCN, including its branches, as well as the University of Oradea (Faculty of Engineering), provide a steady flow of graduates familiar with new technologies. These institutions have begun adapting their curricula to meet the requirements of Industry 4.0: courses in Artificial Intelligence in robotics, rapid prototyping, computer-aided design, cyber-physical systems, etc., competencies increasingly sought after by employers. At the pre-university level, the focus is on expanding vocational and technical education. Technical high schools in the region run dual education programs in partnership with companies, offering students specializations such as CNC operator, automation electrician, tool maker, or mechatronics technician. These partnerships (e.g., with companies like Bosch or Eberspaecher) ensure modern workshops and direct practice in factories, so graduates can be immediately productive. Overall, the educational ecosystem in the North-West is evolving to meet the needs of advanced industries: from raw talent to top specialists, the region invests in human capital to support long-term competitiveness.

R&D

The region has active research and development centers in the field of production technologies, although total R\&D expenditures remain below potential. Technical universities play a major role: UTCN has laboratories in industrial robotics, advanced materials, and manufacturing processes, involved in national and European projects. The University of Oradea has also developed competence centers in mechatronics and robotics, supported by EU funds, which allow equipment testing and the training of specialists. Another pillar of research is dedicated institutes and infrastructures. INCDTIM, a national institute in Cluj-Napoca, focuses on isotopic technologies and advanced materials, where, among other things, nanomaterials with industrial applications are researched. Major multinational companies also contribute to the innovation ecosystem: Bosch has an R\&D center in Cluj focused on mobility solutions and sensors, while Emerson conducts testing and prototyping activities for industrial automation. Participation in European research programs is increasing. However, the challenge remains to build stronger bridges between research and industry, so that scientific results can be transformed into market innovations.

Challenges

• Productivity and Technologization: Many SMEs still operate with outdated technologies and non-automated processes, which limits their productivity. • Widespread Adoption of Modern Solutions: The adoption of modern solutions (from sensors and robotics to control software systems) is uneven – large companies are advanced, while many small firms are just beginning their digital transformation. • Workforce and Skills: The shortage of qualified personnel in modern industrial professions is a constraint. • Innovation and R\&D: Local companies' R\&D spending is relatively low, and cooperation with research institutes is sporadic. • Value Chains and Markets: Integration into European value chains brings both opportunities and vulnerabilities. • Infrastructure and Clustering: Although there are well-established industrial parks, some areas still lack high-quality industrial infrastructure (factories, utilities, logistics). The development of Smart Specialization Parks is still in its early stages – the challenge will be to populate them with enough innovative SMEs and create a real cluster effect.

OUG 112/2022 – Regarding Smart Specialization Parks:

OUG 112/2022 – Regarding Smart Specialization Parks:

Law No. 186/2013 – Regarding the Establishment and Operation of Industrial Parks:

Law No. 186/2013 – Regarding the Establishment and Operation of Industrial Parks:

National Strategy for Competitiveness 2015-2020:

National Strategy for Competitiveness 2015-2020:

National Recovery and Resilience Plan (PNRR)

National Recovery and Resilience Plan (PNRR)

Smart Specialization Strategy of the North-West Region 2021-2027

Smart Specialization Strategy of the North-West Region 2021-2027

The New EU Industrial Strategy (2020, updated 2021)

The New EU Industrial Strategy (2020, updated 2021)

EU Framework Programme Horizon Europe 2021-2027

EU Framework Programme Horizon Europe 2021-2027

European Legislative Framework on Industry and SMEs

European Legislative Framework on Industry and SMEs

Emergency Ordinance 112/2022 regulates the establishment and development of Smart Specialization Parks in Romania. These parks are designed to facilitate innovation, technological advancement, and economic growth by clustering various industries and research activities in specific geographic areas. The aim is to stimulate regional development by concentrating resources, expertise, and infrastructure in sectors that have strong potential for innovation and global competitiveness.

Law No. 186/2013 regulates the establishment, organization, and operation of industrial parks in Romania, providing the legal framework for their development as essential tools for supporting the economy and attracting investments. Industrial parks are meant to support the development of industries by creating concentrated zones where companies can benefit from specific facilities, modern infrastructure, and favorable conditions for conducting economic activities.

The National Strategy for Competitiveness 2015-2020 outlines Romania's approach to improving its economic performance and global competitiveness over a five-year period. The strategy focuses on key sectors, investments, and policies that will help the country enhance its productivity, innovation capacity, and overall economic structure.

The National Recovery and Resilience Plan (PNRR) is a strategic document designed to support Romania’s economic recovery and strengthen its resilience following the impacts of the COVID-19 pandemic. It is part of the broader European Union initiative aimed at boosting the EU's economic recovery and sustainability in the context of the pandemic, through the NextGenerationEU fund.

The Smart Specialization Strategy of the North-West Region 2021-2027 (S3) is a strategic document that aims to identify and capitalize on the region's unique competitive advantages, fostering innovation and economic development. The strategy is aligned with the national and European frameworks for sustainable development, focusing on creating value through research, technological innovation, and sectoral collaboration.

The New EU Industrial Strategy was first introduced in March 2020 and updated in 2021, aiming to strengthen Europe's industrial base, support green and digital transformation, and make the European Union a global leader in innovation, sustainability, and resilience.

Horizon Europe is the EU’s research and innovation program for the period 2021-2027, with a budget of €95.5 billion. It aims to strengthen the EU's global competitiveness in research and innovation, while tackling societal challenges and contributing to the green and digital transitions.

The EU Industrial Strategy aims to promote a green, digital, and resilient industrial base within the EU. It includes measures for strengthening the EU’s industrial sector, with an emphasis on promoting innovation, digital transformation, and environmental sustainability. It also outlines specific actions to support industries in the digitalization and green transition, ensuring that European companies are competitive on the global stage.